Happy New Year! Wall Street had a good 2024, and The Economist magazine describes the US economy as “the envy of the world”.

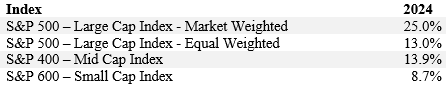

A summary of the returns for the year for various broad market indices is below.

The concentration in the returns of the S&P 500 was highlighted by the difference between the market and equal weighted indices. The median stock in the S&P 500 was up 12.3%, and over 30% of the stocks in the S&P 500 index were down.

Another dichotomy was evident in the bond market, wherein short-term and long-term interest rates moved in opposite directions. With inflation declining, the Federal Reserve started cutting its target Fed Funds rate on September 18. Since then, the three-month Treasury bill yield fell from 4.95% to 4.37% at year-end. But over the same period, the yield on the ten-year Treasury rose from 3.65% to 4.57% on concerns over the federal deficit and certain components of the Consumer Price Index (CPI). If the ten-year yield moves above 5%, that might well set off alarm bells in the stock market; the ten-year has not traded above that level since July 2007.

Economic Overview

During the fourth quarter, economic activity remained strong. Fourth quarter GDP is expected to come in at +2.6% and the unemployment rate has been steady at 4.1%. Inflation readings have remained sticky, with the Federal Reserve’s preferred gauge of inflation, the Personal Consumption Expenditure Index (PCE), ticking up to 2.44% in its most recent reading, up from 2.10% at the end of the third quarter. This has led to lowered expectations for the pace and magnitude of rate cuts expected from the Federal Reserve.

Equity Markets

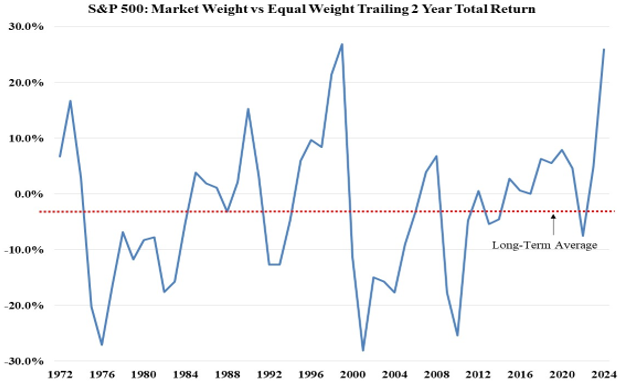

As noted, the stock market has been led by very concentrated equity returns of the largest technology-oriented companies. Over the last 54 years (going back to 1971), the S&P 500 Equal Weighted Index has returned 12.3% annually, 1.2% higher than the Market Capitalization Weighted S&P 500 Index which has returned 11.1% annually over the same period. However, over the last two years, the market cap weighted S&P 500 Index has outperformed the Equal Weighted S&P 500 Index by 25.9%. As shown in the chart on the next page, we have had periods of significant stock market concentration before. The last two years have seen the highest outperformance of the market weight S&P 500 compared to the equal weight index since 1999, the peak of the dot.com era, and above the level of the Nifty-Fifty era of the early 1970s.

Given this backdrop, we remain vigilant in managing stock and sector concentrations. As we have remarked before, the overall valuation levels of the S&P 500 Index are well above historical norms. For example, the Shiller ratio, a well-respected metric which relates corporate earnings over the past decade to current stock prices, ended the year at 37.4 versus an all-time high of 44.2 in December of 1999. Though 18% lower than its historical high, the current Shiller ratio is more than double its century-long average of 17.2. The question is whether these valuations can persist even though the economy continues to grow, unemployment remains low, and the Federal Reserve has started to cut the Fed Funds rate. The market can be vulnerable to pinpricks caused either by unforeseen disruptions or by destabilizing policy choices.

Outlook

With the Administration, Senate and House of Representatives all controlled by the same party, it should be easier to pass the parts of President Trump’s agenda that are not subject to the 60-vote hurdle in the Senate. We thought it would be helpful to lay out the potential economic and market consequences of a variety of proposals that President Trump has signaled would be part of his upcoming agenda.

Taxes: President Trump has proposed cutting the corporate tax rate to 15% from the current 21% rate. The reduction would certainly be a boost to corporate earnings though to a lesser degree than the reduction in 2018 from the then 35% corporate tax rate.

On the personal income tax side, Trump has proposed extending the tax cuts enacted in his first term, due to expire at the end of 2025.

Reducing taxes would certainly be stimulative to the economy and taken alone should generally be positive for stocks. But the effects could be potentially offset if the cuts helped reignite inflation concerns or if interest rates were to rise on concerns about a widening fiscal deficit. Long term rates could rise even if the Fed continues to cut short-term rates.

Immigration: Part of the rise in inflation during the pandemic was attributed to labor shortages, which were partly due significant drops in immigration and some outmigration at the early stages of the pandemic. This was particularly acute at the low end of the wage scale in areas such as agriculture and basic services. Significant deportations of workers could reignite concerns about labor shortages and their associated inflationary pressures.

Government Spending / Regulation / Mergers & Acquisitions: The Government Efficiency effort led by Elon Musk and Vivek Ramaswamy could be a double-edged sword. Trimming true waste should be a positive for the economy, but not necessarily for government contractors – especially those in the defense space. Musk thinks their contracts are way too padded. Cutting unhelpful or outdated regulations should be a positive. But too much cutting could be contractionary to the economy, destabilizing to the markets, or both.

President Trump has selected Andrew Ferguson as the next chair of the Federal Trade Commission (FTC), replacing Lina Khan, an ideologue who blocked many corporate acquisitions. A more lenient regulatory environment could result in an increase in mergers and acquisitions activity which could be positive for equities, especially stocks of small and mid-size companies.

Energy: President Trump has highlighted energy costs as a driver of inflation and has touted “unleashing American Energy” as his focus. Trump has designated North Dakota Governor Doug Burgum essentially as “energy czar”. Burgum has been described as an “all-of-the above energy governor” arguing for renewables as well as traditional oil and gas. A significant ramp up in energy production could help moderate inflation and lower production costs, in particular for domestic manufacturing. We note that utility stocks have been uncommonly strong (and richly valued) as AI has sharply increased the demand for energy.

Tariffs: An area where President Trump has deviated from Republicans of the past has been his focus on and admiration for tariffs (“the greatest thing ever invented”). President Trump has even suggested replacing the federal income tax with significant tariffs. Tariffs are viewed generally as inflationary, as it raises the prices that consumers pay on imported goods. As a consumption tax, tariffs also tend to curb domestic economic activity. Further, they can have a contractionary impact on world trade, which generally leads to a contraction in worldwide economic growth.

A key factor will be to what extent other countries respond with their own tariffs on American exports, which would slow global trade. The most notable example of previous tariff wars was the Tariff Act of 1930 (commonly know as the Smoot-Hawley Tariff), which faced retaliatory tariffs from many other countries, and is often credited with accelerating and deepening the Great Depression. The stock market declined by 25% in June of 1930, when the Smoot-Hawley tariffs were signed into law. We do think that Treasury Secretary designate Scott Bessent understands these risks, but we will monitor this situation closely.

The question will be the size and the range of tariffs, and whether or not they are used more as a bargaining chip in negotiations with other countries, or a more permanent form of taxation that curbs global trade. In Trump’s first term, the stock market exhibited short-term volatility around his various tariff announcements. It is important to note that some of the tariffs were kept in place under President Biden, and that the tariffs that President Trump has now suggested are larger and wider ranging than those he has implemented in the past.

Domestic Reshoring: A large part of the Trump agenda is focused on bringing manufacturing back to America. This has largely seen support from across the political spectrum. President Biden has signed bi-partisan legislation, such as the CHIPS and Science Act intended to boost investment in domestic high-tech research as well as bring semiconductor manufacturing back to the US. Significant reshoring could have a meaningful impact on certain parts of the domestic economy.

The bottom line is that key industries are humming away, profits are growing in some spots at levels that were unimaginable a generation ago, and government policy should be quite business-friendly. The big question is how much of this is already reflected in stock prices. The risk-reward balance has gotten a bit more tilted; the likelihood of continued reward is high, but the level of risk has also grown due to high valuations.